In reading the Quarterly Mortgage

Banking Association’s (MBA) Q1 2022 loan originations report, readers would expect

a thriving economy in 2022 and predict another year of record low interest

rates, especially for owners of industrial real estate. Some of the headline stats:

· Commercial and multifamily loans up 72% compared

to first quarter 2021

· Loans on industrial assets increased by 145% compared

to first quarter 2021 (highest increase per product type)

However, the global economy

and lending universe have quickly changed, and a large portion of the positive

origination gains in Q1 2022 is from loans sourced in Q4 2021. We have officially entered the

long-anticipated, higher interest rate environment due to the highest inflation

levels in 40 years, which is directly attributable to the amount of liquidity

created by the Federal Government, supply chain issues, labor shortages, a

global threat of war, and the on-going pandemic. Below is a summary of recent trends in the

debt markets and how it relates to industrial real estate:

Life Insurance Companies

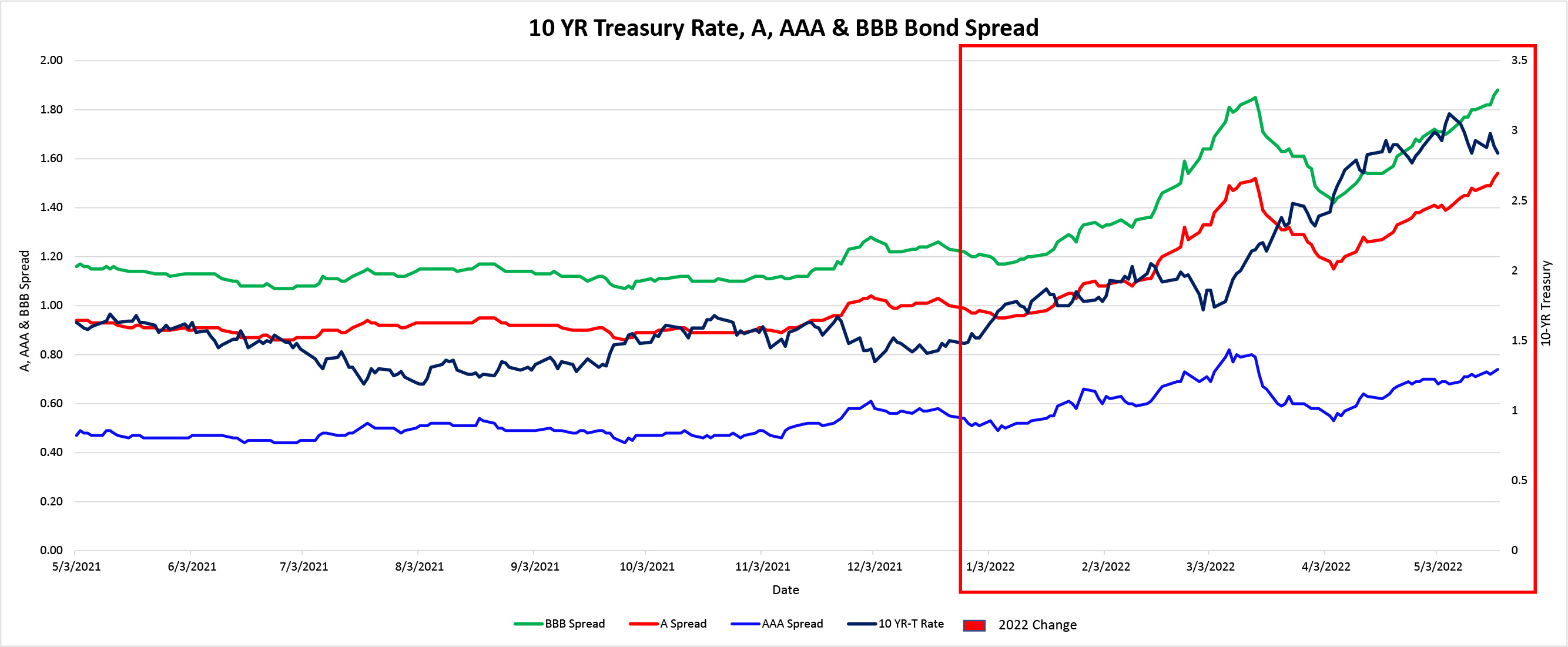

Life insurance companies

generally price mortgages using the corresponding US treasury rate as the

standard pricing index. Since January

2022, the 10-year US treasury has increased from 1.63% to 2.81% (May 20, 2022),

and it actually touched 3.12% in early May (see blue line in Exhibit A). Life insurance companies also follow both the

A corporate and BBB corporate bond spreads (see red and green lines in Exhibit

A), and generally aim to price their mortgages 20-40 bps higher than the

equivalent bond spread (on average) as an illiquidity premium. Historically, as US treasury rates rise,

insurance companies have been able to tighten spreads to reduce all-in

borrowing costs when A and BBB corporate spreads remain constant. However, A and BBB corporate bond spreads

have widened in recent months, providing an alternative liquid investment for

insurance companies and causing mortgage pricing to take a double hit (increase

in index, increase in credit spread).

Since January 2022, mortgage spreads have increased from 120-180 bps to

160-220 bps on average, resulting in at least a 150-200 bps increase in all-in

interest rates. Although pricing has

widened, insurance companies have the ability to fix rates for 10+ years and

whole interest rates at application for up to 120 days, which can be a real

competitive advantage in this environment.

Insurance companies continue to heavily focus new originations on

industrial and multifamily assets, so industrial real estate owners will

continue to see best pricing in the market.

Banks

Despite the fixed rate

permanent market adjusting in anticipation of interest rate hikes, the banks

did not see much change until the Fed raised its benchmark interest rate by 25

bps on March 14 and 50 bps on May 4. The

initial 25 bps increase in March increased both WSJ Prime and SOFR accordingly,

which are common indices used by the banks.

Although not insignificant, the 25 bps increase to Prime and SOFR were

nominal increases compared to the increase within US treasury market, creating

a window of opportunity for the banks to be the price leaders. In late March, banks were still pricing

fixed-rate mortgages between 3.50-4.00%, when the majority of other lenders

were higher than 4.00%. The second rate

hike on May 4th has created much more turbulence and confusion. Since the 50 bps rate increase in May, bank

interest rates have widely varied from 4.50-5.50%, as lenders struggle to

accurately price risk in a time of rising interest rates. We have also witnessed firsthand that fewer

and fewer banks are willing to rate lock a mortgage prior to closing, given the

quickly changing nature of their cost of funds.

Debt Fund / Bridge

Following the theme of higher

yielding alternative investments, debt fund pricing on transitional value-add

real estate has also seen a double hit with the increase in SOFR. Credit spreads, which were 300-500 bps in

2021, are now ranging 375-575 bps on similar assets. More importantly, however, is that debt fund

lenders are starting to decrease leverage, in preparation for higher interest

rates today and in the future. Value-add

multi-family loans, which were once regularly sized to 75-80% loan-to-cost, are

now being sized to 65-70% loan-to-cost due to refinance exit tests using higher

loan constants. Think about that:

value-add multifamily deals that were getting done at 80% loan-to-cost in the

low-3% interest rate range in 2021 are now starting to get done at 65%

loan-to-cost in the mid-4% range.

While we recognize that the market was overdue for some correction, the constant volatility can be exhausting. We are all hoping for some level of stability and consistency, but we anticipate continued volatility in 2022. Here are our thoughts and advice for today’s environment:

· Anticipated higher interest rates for the foreseeable future, and diligently incorporate them into your underwriting for on-going cash flow and exit stress tests.

· If you are a committed long-term holder of a specific real estate asset, 4.25-4.50% fixed rate non-recourse debt is still available. We have become so accustomed to 3.00% mortgage rates in the last two (2) years that we forget about historical context. The industry originated millions of dollars of 4.50% loans in 2018 when the 10-year treasury was around 3%.

· There will be a “flight to quality” where lenders will seek more predictable, stable cash flows and asset types. This bodes really well for industrial assets, given the current demand and performance this past cycle. Industrial (and multifamily) assets will continue to get best in class terms in 2022.

· Consistent with this cycle, lenders will stick to underwriting fundamentals, stay disciplined, and not get too aggressive to place capital. As a result, we will start to see lower loan-to-values/loan-to-cost, mainly driven by exit/refinance risk with higher loan constants.