The start of a new year provides us with a chance to reflect on the

past twelve months and identify a few key insights into the capital markets that

our Borrowers can hopefully take advantage of heading into 2018.

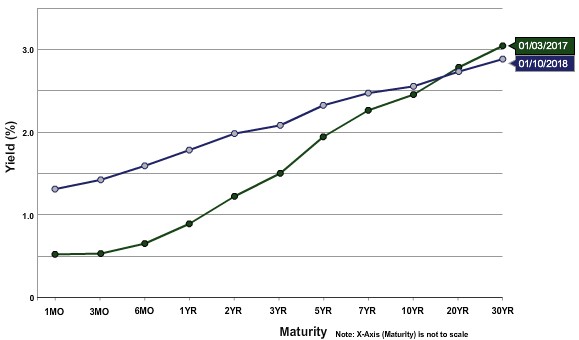

Perhaps the most dramatic change in the debt markets in 2017 was the

flattening of the yield curve, brought on by the Federal Reserve’s decision to

raise its target for the short term federal funds interest rate on three

separate occasions in March, June, and December. The federal funds rate is the

interest rate that banks charge each other for overnight loans, and as a result,

has a more direct impact on short-term interest rates.

The chart above shows the yield curve of bonds issued by the US

Treasury Department with various maturities at the start of 2017 and at the

start of 2018.

Short term interest rates are commonly used as the benchmark rate by local, regional, and national money center banks when issuing short-term, floating-rate debt utilized by many commercial real estate owners to finance their portfolios. Floating rate debt got much more expensive in 2017, as 1-Month LIBOR rose from 0.77% in January 2017 to 1.56% in January 2018. Short-term rates are forecasted to increase even further, as the Federal Reserve is eyeing three additional rate increases in 2018.

On the contrary, yields on 10-Year UST bonds (the most common benchmark

for long-term debt issued by life insurance companies) changed very little in 2017

(increasing by only 10 bps).

Additionally, average interest rate spreads have compressed, as more

capital continues to seek predictable, strong yields from commercial real

estate mortgages. We believe that these diverging dynamics make securing

fixed-rate, long-term debt from our correspondent life insurance companies more

attractive than any time in the past year. Life companies are now able to match

or beat interest rates on short-term bank debt, but with the added benefits of

being non-recourse to the Borrower, and locking in a low interest rate for a

period of 10-years or more, reducing interest rate risk from an investor’s

portfolio.

However, this dynamic may not last for long, as a recent article from

Bloomberg outlines (see link below). In short, as the US deficit grows, the Treasury

Department needs to borrow more than ever to service the existing debt, but the

entities that typically buy US debt are changing their habits. Analysts

expect the demand for USTs from foreign central banks to decline as their

reserves of foreign capital have increased in recent years. Instead,

foreign demand is expected to be replaced by “household” buyers, which include

hedge funds, private equity firms, and trusts for wealthy individuals.

These buyers need to be enticed to buy USTs with higher yields, so Goldman

Sachs expects the yield on the 10-year UST to rise to 3% by year-end.

This exact scenario was recently in the news on January 10th,

as officials of the Chinese government recommended slowing or halting purchases

of US Treasury bonds (see link below). The

impact of the news was felt immediately, as the yield on the 10-Year UST

increased to a 9-month high of 2.59% before ending the day at 2.56%. While some

analysts see this announcement from China as nothing more than political

posturing as trade tensions with the US heat up (see link below), the news

highlights how sensitive yields on US Treasuries can be.

With a flattened yield curve and continued low interest rates for long-term

loans, life company debt remains very attractive in the early part of

2018.

Links:

US Treasury Sales are About to Double in 2018. Who’s Buying?

China Weighs Slowing or Halting Purchases of US Treasuries

China Treasuries Unease Mostly Political Posturing, Analysts Say